Thailand has firmly established itself as the global leader in the branded residence sector. Currently controlling 23.3% of the Asia-Pacific market, the Kingdom offers a unique proposition for international investors: luxury assets that combine private ownership with the service standards of world-renowned hospitality brands.

For investors, the appeal goes beyond prestige. It is about performance. Market data indicates that branded residences in Thailand are seeing sales increase by 20% year-over-year, driven by high-net-worth individuals seeking assets that offer both lifestyle benefits and tangible financial returns. Whether you are looking for capital appreciation in a bustling CBD or rental yields from a beachfront villa, the Thai market offers diverse opportunities.

In this guide, we explore the best branded residences in Thailand for investment, analyzing their location, unique selling points, and financial potential.

Before diving into specific properties, it is essential to understand the landscape. Thailand’s luxury real estate market was valued at USD 71.27 billion in 2024 and is projected to reach USD 88 billion by 2030.

This growth is fueled by global wealth migration and a robust recovery in tourism. With government initiatives like the Thailand Elite program and visa-free entry policies, demand for high-end residential bases is accelerating. Bangkok dominates transaction volumes with ultra-luxury pricing, while Phuket and emerging coastal markets like Hua Hin and Sichon offer compelling entry points for those seeking higher rental yields.

Here are the top seven branded residences currently shaping the investment landscape in Thailand.

Location: Phra Khanong, Sukhumvit

Investment Profile: Urban Sophistication & Heritage

La Clef Residences 38 combines Thai cultural influences with French design heritage in a modern, refined setting. Located in the heart of the Sukhumvit district, the residences sit above La Clef Bangkok by The Crest Collection, offering a rare chance to own freehold ultra-luxury property in central Bangkok.

From an investment perspective, the project stands out due to the limited supply of freehold units in this prime area. Residents benefit from world-class hospitality services, including exclusive à la carte dining curated by Michelin-starred chefs. These features strengthen the property’s premium lifestyle appeal. Select three-bedroom suites are priced at around $5.9 million, placing La Clef Residences 38 firmly in Bangkok’s ultra-luxury market, where brand strength and long-term value preservation are key drivers.

Location: Rajadamri Road, Lumpini

Investment Profile: Established CBD Luxury

The St. Regis Bangkok is a landmark luxury residence located on Rajadamri Road, one of the most prestigious addresses in the city. Positioned in the heart of Bangkok’s main business and shopping district, the property offers direct access to the BTS Skytrain, making connectivity seamless.

For investors, the appeal lies in the strength and reliability of the St. Regis brand, known globally for its service standards and long-term prestige. Residents enjoy the brand’s signature 24-hour Butler Service, along with full access to five-star hotel amenities. Select four-bedroom residences are priced at around $5.49 million and feature floor-to-ceiling windows with open views of the Royal Bangkok Sports Club. With limited remaining land in this prime CBD location, The St. Regis Bangkok continues to be regarded as one of the city’s most stable and desirable ultra-luxury residential assets.

Location: Nakhon Si Thammarat

Investment Profile: Emerging Market Growth

Banyan Tree Residences Sichon is designed for buyers looking beyond the mature markets of Bangkok and Phuket. Located on the untouched coastline of southern Thailand, the project offers a rare opportunity to enter an emerging luxury destination at an early stage.

The development consists of just 15 exclusive beachfront pool villas, ensuring privacy and long-term scarcity. A typical four-bedroom villa spans approximately 814 square meters and is priced at around $1.7 million, offering a significantly lower entry point compared to established resort markets such as Phuket. This early-stage pricing makes Sichon an attractive option for buyers seeking long-term upside as the area continues to develop.

Residents enjoy full access to the Banyan Tree lifestyle, including a private clubhouse, gourmet restaurant, full-service spa, fitness center, and dedicated concierge and butler services. Villas are available on a 90-year leasehold structure for foreign buyers and freehold for Thai buyers, making Banyan Tree Residences Sichon a compelling option for both lifestyle ownership and long-term asset positioning.

Location: Hua Hin

Investment Profile: Accessible Coastal Luxury

The Standard Residences Hua Hin brings a fresh and modern energy to one of Thailand’s most established seaside towns. While Hua Hin has long been known as a retreat for Thai royalty, this beachfront condominium project introduces a youthful, design-led lifestyle to the local market.

Located just ten minutes from Hua Hin town center, the development combines Thai cultural influences with contemporary architecture, art, and landscaping. Residents enjoy direct beach access and exclusive privileges at The Standard Hua Hin hotel, creating a lifestyle-focused coastal experience.

From an investment perspective, the project offers a relatively accessible entry point into branded residences, with select units priced under $1 million. The Standard brand has a strong following among younger, design-conscious travelers, which supports long-term rental appeal. In addition, Hua Hin continues to benefit from ongoing transport and airport infrastructure improvements, strengthening its outlook as a long-term lifestyle and residential destination.

Location: Pattaya

Investment Profile: Architectural Landmark

Wyndham Grand Residences Wongamat Pattaya is Thailand’s first Wyndham Grand–branded residential development. Rising 36 floors near Wongamat Beach, the project stands out for its distinctive architecture, highlighted by curved glass balconies and wide panoramic views of the Gulf of Thailand.

The development reflects Pattaya’s shift toward a more lifestyle-driven and upscale residential market, where branded residences play a growing role. One-bedroom freehold units start at around $133,000, offering an accessible entry point for investors seeking a globally recognised hospitality brand backed by Wyndham’s five-star standards.

Residents enjoy a full range of resort-style amenities, including onsen pools, fitness and wellness facilities, sky lounges, and a 360-degree observation deck. Together, these features create a modern coastal living experience designed to remain attractive to both end users and short-stay lifestyle buyers.

Location: Laguna, Phuket

Investment Profile: High-Yield Beachfront

Located within the well-established Laguna Phuket integrated resort, Laguna Beach Residences Bayside offers a collection of contemporary low-rise condominiums and penthouses designed for relaxed island living. The project is surrounded by lakes, canals, and landscaped walkways, creating a calm resort atmosphere just minutes from Bang Tao Beach.

The residences feature one, two, and three-bedroom layouts with light, modern interiors inspired by the surrounding water and natural scenery. Select penthouse units include private rooftop pools, while all residents enjoy access to a large freeform swimming pool that flows through the development, along with private terraces and lush outdoor spaces.

Owners benefit from full access to the wider Laguna Phuket lifestyle, including golf courses, spas, restaurants, and resort facilities. The residences are offered on a leasehold ownership structure, making them well-suited for buyers seeking a lifestyle-focused property within one of Phuket’s most established resort destinations, with long-term rental and resale appeal driven by the strength of the Laguna ecosystem.

The premium price tag attached to branded residences is justified by superior performance metrics compared to non-branded luxury properties.

Capital Appreciation

Data shows that branded properties in prime locations appreciate at 12-18% annually, compared to just 5-8% for non-branded alternatives. This is largely due to supply scarcity and brand equity. A Ritz-Carlton or Four Seasons residence maintains its status regardless of market cycles, providing a safety net for value.

Higher Rental Yields

While gross yields may look similar on paper, net yields for branded residences are often superior. Professional operators manage yield management, occupancy, and marketing, achieving higher nightly rates. Investors typically see net yields of 5-7% in Bangkok and up to 10% in resort markets like Phuket, without the hassle of self-management.

Operational Simplicity

Owning investment property can be a second job. Branded residences eliminate this. The hotel operator handles tenant sourcing, maintenance, and compliance. You receive a statement and a check, not a midnight call about a broken pipe.

Factors to Consider Before Buying Residences in Thailand

While the rewards are high, due diligence is critical.

Foreign Ownership Laws

Thailand’s Condominium Act limits foreign freehold ownership to 49% of the building’s total floor area. If this quota is full, you may be offered a leasehold structure (typically 30 years renewable). Ensure you clarify the ownership structure early in the negotiation.

Location vs. Brand

Do not rely solely on the brand name. A top-tier brand cannot fix a poor location. Bangkok’s CBD offers stability, while Phuket’s west coast offers higher growth but with more volatility tied to tourism cycles. Diversification across these geographies is a prudent strategy.

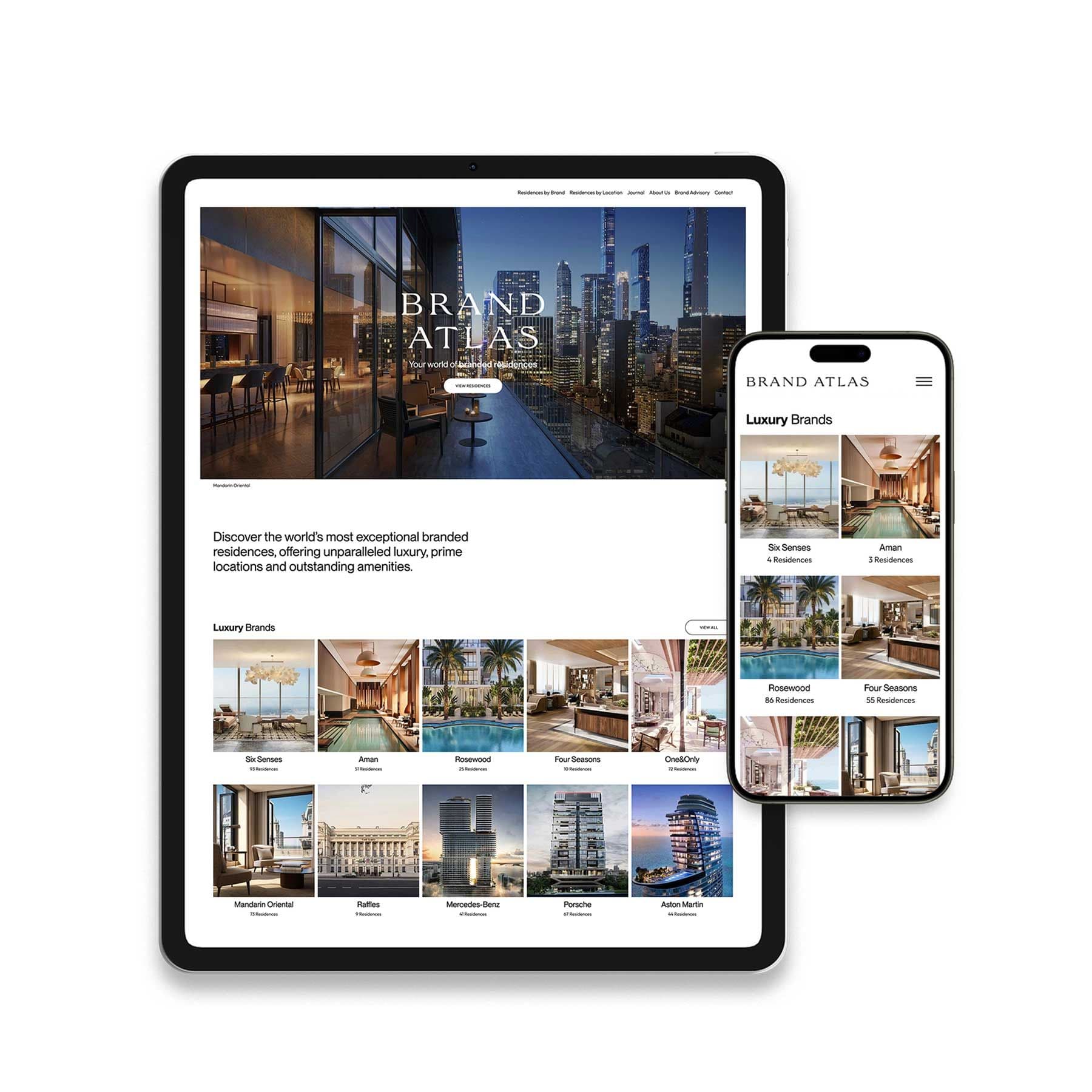

Offering the definitive collection of the finest luxury branded residences in the most coveted locations, we give buyers and brands a unique opportunity to connect in this highly desirable and fast-growing market.

We work exclusively with leading brands, recognising the loyal relationship they share with their international audiences - and the exciting extension of luxury lifestyles through exceptional properties.

Providing an unparalleled and unbiased global overview, we enable buyers to see where their favourite brands are developing residences and to enjoy exploring and experiencing these exceptional properties.

Brand Atlas showcases the world’s finest branded residences on one digital platform, allowing global UHNW buyers access to a definitive collection of properties through a prestige network and top-tier technology.

While the world watches for a rebound, Chinese ultra-high-net-worth capital has already made its move. Demand is no longer scattered; it is concentrated in five "Fire Horse" cities: Dubai, Bangkok, Singapore, London, and Tokyo. For developers, the win isn't just about location, but about "Brand Certainty." Projects that lead with professional operators and service-led design are capturing this demand before the competition even wakes up.

Today’s families want homes that adapt to education, mobility, and legacy planning. Branded residences deliver familiarity, professional care, and peace of mind, wherever life takes them. A new model for living across borders.

Chinese buyers are back in the market, but the rules have changed. Certainty now matters more than speculation, and brands matter more than ever. Developers who understand this shift will move first.

Management Quality

The value of your asset is tied to the condition of the building. Established brands like Banyan Tree and Ritz-Carlton have decades of experience maintaining properties to five-star standards. Be cautious with newer, unproven brands that may not have the financial depth to maintain rigorous upkeep over 20 years.

Securing Your Global Asset: Final Takeaways

Thailand's branded residence market offers a sophisticated vehicle for wealth preservation and growth. Whether you are captivated by the heritage of La Clef in Bangkok or the beachfront potential of Sichon, these assets deliver a combination of lifestyle and financial return that is difficult to match elsewhere in Asia.

The key is to look beyond the marketing and understand the fundamentals of location, management, and legal structure. By choosing the right asset, you secure not just a home, but a high-performing piece of the global hospitality economy.

Ready to explore these opportunities further? Visit Brand Atlas to view our full portfolio of luxury developments.